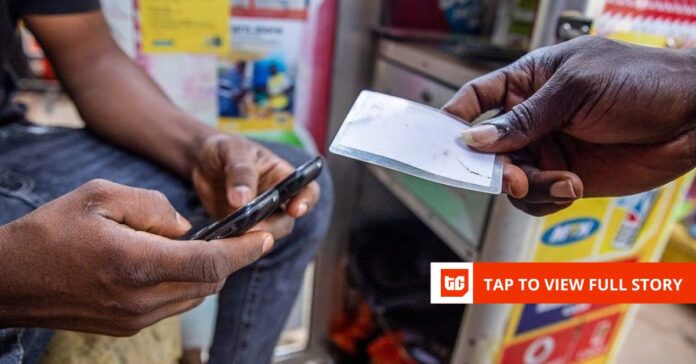

When Kemi Michael, a corporate compère, attempted to transfer money to her usual PoS agent in late 2024, the attendant had a tip for avoiding an extra charge: “Send ₦9,500 instead of ₦10,000 so I don’t have to add ₦50 to the withdrawal fee.”

According to her, it worked for a while but was not sustainable. That ₦50 charge, the Electronic Money Transfer Levy (EMTL), was extended to fintechs like Opay, Palmpay, and Moniepoint in December 2024, and in six months, increased government revenue by ₦84.97 billion, according to Federation Account Allocation Committee (FAAC) data.

Between December 2024 and May 2025, EMTL revenue reached ₦185.86 billion, an 84.22% rise from the ₦100.89 billion recorded during the corresponding period of 2024, confirming the government’s motivation for extending the levy to fintechs.

In 2024, the government required fintech operators to comply with EMTL in line with the Federal Inland Revenue Service (FIRS) regulations. Although the levy was initially set to start in September 2024, implementation began in December.

The EMTL, introduced in the Finance Act 2020 as an amendment to the Stamp Duty Act, imposes a ₦50 charge on electronic transfers of ₦10,000 and above, initially applying only to banks.

The levy was meant to diversify revenue away from oil and tap into Nigeria’s booming e-payments market, which hit ₦1 quadrillion in 2024.

As banks struggle to meet digital demand, fintech firms have stepped in, processing ₦46.91 trillion worth of transactions in 2023 and ₦79.55 trillion in 2024. These mobile-first neobanks have become vital for the roughly half of Nigerian adults who remain unbanked or underserved, especially in rural areas.

Olayemi Cardoso, the Central Bank of Nigeria governor, noted that the adoption of digital payment channels using mobile technology has been a transformative tool for financial inclusion, which stood at 64% in 2023.

“There is still a gap in the number of adult population that is unbanked, and this responsibility falls on fintechs,” said Chika Nwosu, managing director of Palmpay, during a recent TV interview.

Transaction values through mobile money platforms such as Opay and Palmpay increased by 2,507.94% between 2020 and 2024. The appeal of neobanks lies in the promise of near-instant, low-cost, or free transfers.

“Fintech services, like transfers, are provided free of charge, or nearly so,” Nwosu emphasised.

Initially, extending EMTL to fintechs was seen as a potential deterrent for users. According to GSMA, the global organisation for the telecom sector, additional taxes could threaten the success of e-payments.

In a study, the organisation revealed that additional taxes on mobile money transactions in Uganda caused a 24% drop in overall industry transaction values in 2018. In 2019, new taxes on mobile money led to decreases in transaction values and volumes in the Republic of Congo.

However, Nwosu noted that customers have since adapted. “This is a government policy, there is nothing we can do about it, and customers are okay with it and are not complaining anymore,” he said.

While the government aims to increase tax revenue from EMTL, the bigger challenge remains incentivising transfers of ₦10,000 and above, as microtransactions — which gained prominence after the CBN’s unsuccessful cashless policy initiative — dominate.

“Transfers below ₦6,000 make up about 45% of transfer transactions. Those in the range of ₦10,000 are around 25%,” an industry source commented. PalmPay, Opay, and Moniepoint grew rapidly on small-ticket transfers, offering speed at almost no cost.

While these transfers might not generate more taxes for the government, it bodes well for financial inclusion. “The goal remains financial inclusion,” added Nwosu.

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot.techcabal.com